Review: EveryDollar budgeting app

Published on March 30, 2025

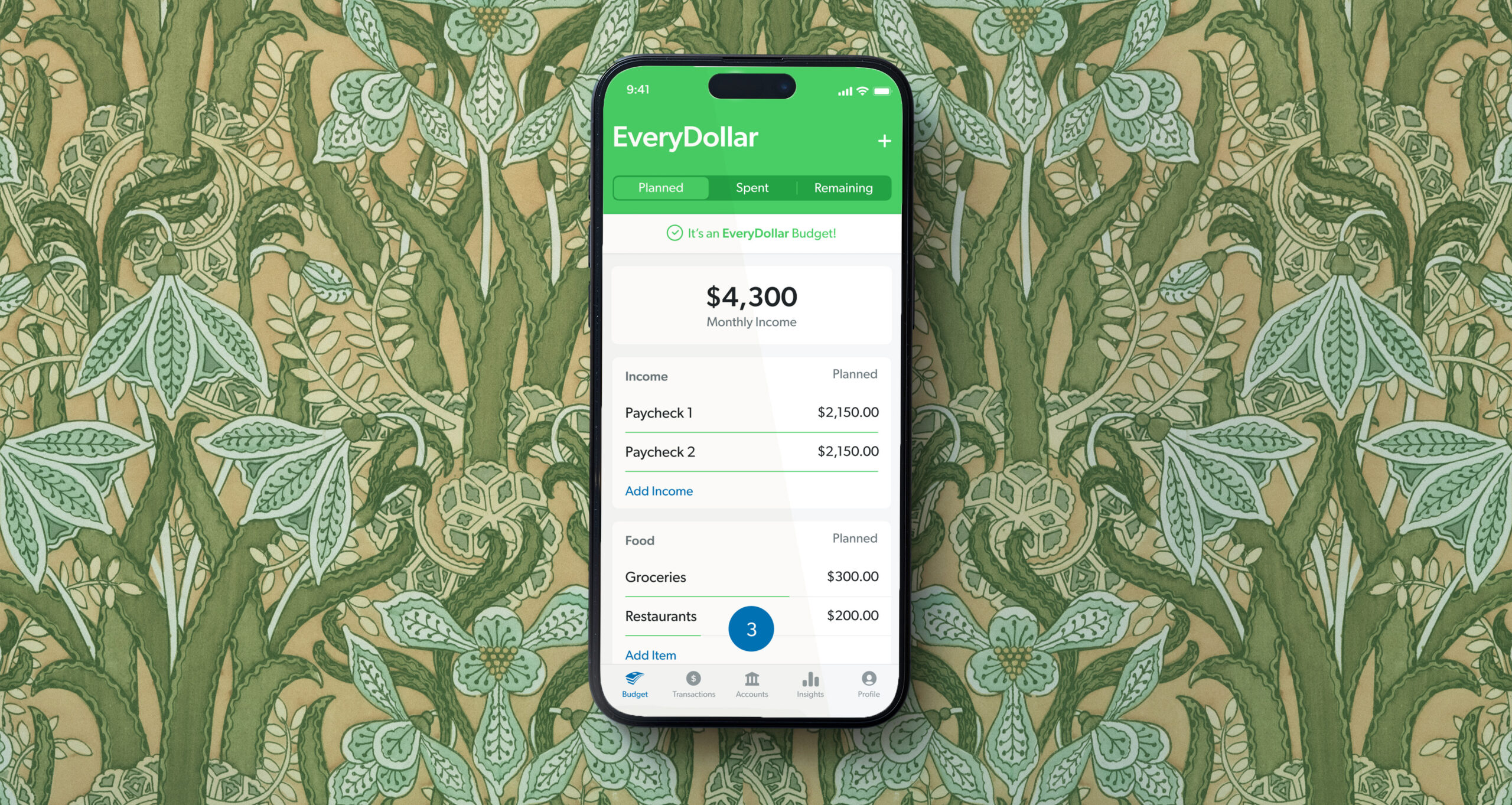

EveryDollar is a simple, zero-based budgeting system created by personal finance expert Dave Ramsey. While Ramsey’s financial advice may not appeal to everyone, EveryDollar is accessible and easy to use. The app offers a free tier and a premium subscription for added convenience. Families or couples may prefer the $7/month subscription, which allows for bank and credit card syncing, while single users might find the free version sufficient, though it requires manual transaction entry.

We checked it out for you ahead of time. Here are the benefits and pitfalls of this option!

Looking for more budget app reviews? Check out our YNAB play-by-play as well!

Pros

Simple and streamlined

EveryDollar is user-friendly and has a minimal learning curve. The interface is intuitive and functions smoothly across multiple devices. Users can sync various account types, and once an expense is manually categorized, EveryDollar remembers the selection for future transactions—saving time. Unlike some budgeting apps, EveryDollar does not automatically categorize transactions, ensuring users remain aware of every expense.

Detailed but not restrictive

Users begin by inputting their “planned income,” which is later marked as “received income” once deposited. This forward-thinking approach helps with budgeting in a more flexible manner compared to stricter methods like YNAB’s envelope-style system. The app allows users to anticipate expenses and adjust their spending proactively rather than reacting after funds are deposited.

Works regardless of your financial philosophy

Dave Ramsey’s well-known anti-credit card stance may not resonate with all users. Fortunately, EveryDollar remains a useful tool whether or not you follow his financial strategies. While the app includes a debt tracker aligned with Ramsey’s “Baby Steps,” it can be easily ignored or adapted to different budgeting styles.

Cons

Limited analytics

One drawback is the lack of customizable analytics. While the app provides reports for 3-, 6-, and 9-month increments, it does not offer shorter timeframes or more detailed trends. However, data can be exported for those willing to analyze spending patterns in Excel or another tool.

Beginner’s only? Limited financial overview

EveryDollar primarily tracks income and expenses rather than providing a comprehensive financial snapshot. While it includes some features for fund creation and surplus rollover, its primary function is monitoring net spending. Users seeking deeper financial insights or long-term investment tracking may find it lacking.

The bottom line

EveryDollar is a solid choice for those who want a simple, hands-on budgeting tool without unnecessary complications. While it may not offer advanced analytics, its ease of use and flexibility make it a great fit for anyone looking to take control of their finances—whether or not they follow Dave Ramsey’s playbook.